List of red flags

Any one of these red flags in your business make growth challenging.

We have proven solutions for all of them.

- Gross margin less than 35%

- Year to year demand for company offerings fluctuates making planning difficult

- Growing credit line

- People with âManagerâ titles not empowered to make business decisions

- Workflow and hand off to next role not clearly understood and managed

- Employees with key knowledge have left

- Hard to find and keep employees

- Donât discover problems that cause poor profitability until itâs too late to fix them

- More than 20% of revenue comes from one or two clients

- What used to work to attract business isnât doing the job anymore

- Details

- Lorraine McGregor

- Uncategories

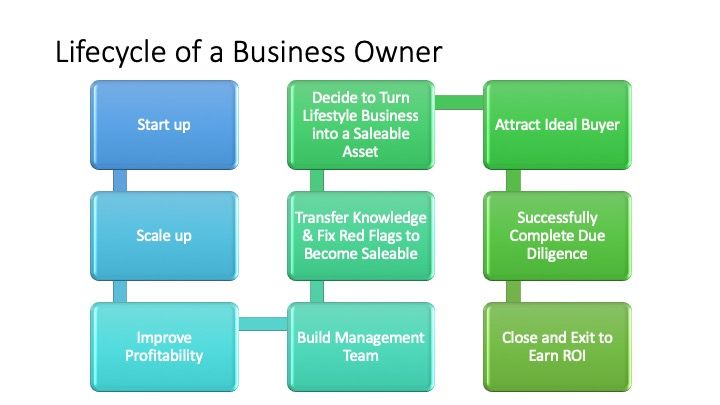

Think You Can Sell a Business When you Want for What you Want? Time for a Reality Check

With the fact that over the last 20 years, roughly the same number of companies sell in the lower middle market as the previous years, despite the fact there is far more cash searching for acquisitions should make every owner pause and find out why. That is what this article is about.

More

Should you Expand Your Business, hosted by Spirit West Management

What goes into the evaluation about whether and how to expand is a tough decision process. What should you pay attention to... Especially if you've tried growing the business before and didn't like the costs or the ROI?

More

Are you and your team growing from your Mistakes

Are you and your team growing from your MISTAKES? Oooh, that word, is so harsh! I've renamed that word 'MISTAKE' (and that frazzling moment of realization) in my head to "personal growth workshop".

More

Just Lost a Key

Itâs the week after a key linchpin employee decided to move on to greener pastures. You discover this manager had many of their own ways of doing things⌠that others donât know about.

More

Scaling Up Your Business? Organizational Hazards Need to Become Projects

When you're scaling up your business, one of the biggest challenges is realizing that there are new responsibilities. Have they been assigned in a way that gets you traction... that people have the time and ability to carry out?

More

What Are the Top 3 Attributes Need to Breakthrough Your Companyâs Growth Ceiling

Question: What do you think are the top 3 attributes that give you confidence that a company will successfully break through their growth challenges and keep going without people and parts breaking off?

More

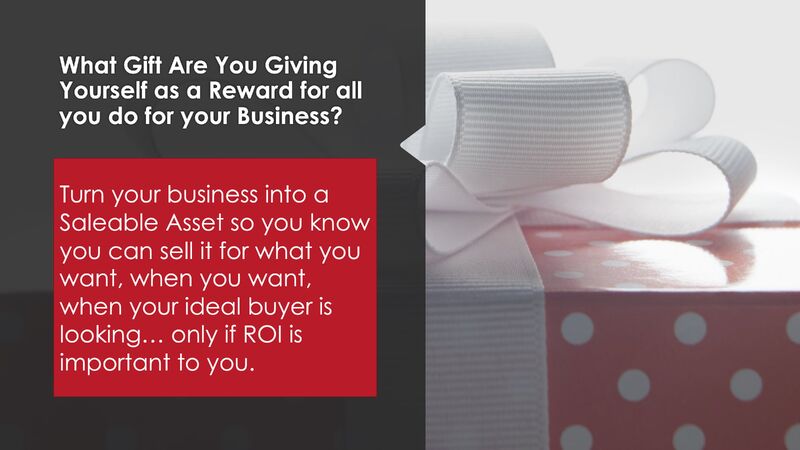

Wishing for Something this Christmas that Wonât Fit Down the Chimney?

Wishing for something this Christmas that won't fit down the chimney? Here's a gift idea for the business owners out there. Consider what return on investment, ROI means to you.

More

What Gift Are You Giving Your Business This Year?

Sometimes the gifts we really want can't be wrapped up and put under the tree. What do you really want in your stocking this year that will really help your business?

More

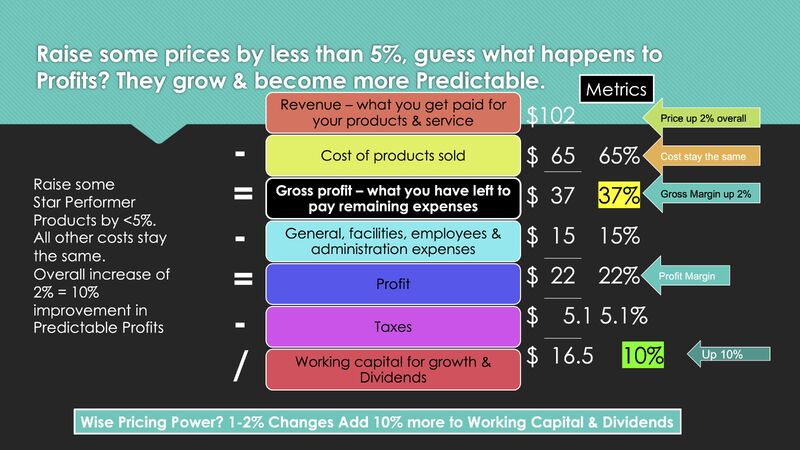

Want More Predictable Profits?

Want more predictable profits so you have the cash flow needed for growth? Last week, I asked you what your favorite benchmark was in 2023 to tell you how well your company is doing. Boosting Gross Margin is my Number 1 predictable profits power producer.

More

Give Some Love to Gross Margin Next Year

Looking back at 2023, and looking at your company's numbers, what's the number you are most proud of? What data tells you the business is on the right path? Have you been pouring your excitement into Revenue Growth?

More

How we Bring Your Team Together to Grow Your Business to the Next Level

More

Own a Business? Has Anyone had the Talk with you yet?

More

How to See the Blind Spots Pre & Post Acquisition to Minimize Integration Woes

The statistics are grim for successful mergers and acquisitions. 70% to 90% fail according to Harvard Business Review. It's been very hard to pin down the myriad issues. Yet these failures haven't slowed down the drive to buy growth through acquisitions.

More

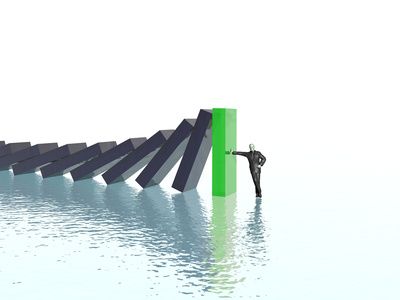

Are you in the Process of Trying to Sell?

Are you in the process of trying to sell or considering what to do to make your business saleable ASAP so that you don't pay double US capital gains tax after December 31st?

More

Want to Avoid Big Capital Gains Taxes Upon the Sale of Your Business? Start 2 Years Before

So you are thinking of selling your business this year to avoid the big hike in US Capital Gains. You may already be talking to M&A advisors trying to find the right fit, the number you want and a team that will get it done before Dec 31st.

More

Having Frustrations With Your Business Partner?

Having frustrations with your business partner? Can't see eye to eye on where the business should go next? Is one of you wanting out from the vital role he or she plays?

More

As a Business Owner Where Does Real Freedom Come From

As a business owner, where does real freedom come from? You might have some immediate answers like 'not having to come in on Fridays because you know your team can handle things', or having the cash flow confidence to know when you can hire with the key expertise you need.

More

So is this the Right Time to Sell Your Business?

You've probably heard the news - lots of mergers & acquisitions action out there. So is this the right time to sell your business? Taking this step could be a milestone year in your life if you are a business owner.

More

Got Workplace Conflict? Tired of Conflict Resolution?

Got conflict? Sales teams struggling with the baggage? Tried a bunch of solutions that have just sent it underground? Performance suffering? Fed up with how long it takes to sort through all the after-effects? This is for you.

More

Is Conflict on B2B Sales Teams Inevitable or Preventable

Do you think conflict on B2B Sales teams is inevitable, meaning you'll always be dealing with the endless headaches, having to be a referee for personal grievances and long simmering arguments between sales and marketing?

More

The Cost of Conflict Zaps Productivity So Why Are You Not Learning How to Prevent It?

f you discovered something was costing your company thousands (or more) per year and it wasn't in your budget, wouldn't you want to stop it? What's lurking in your business?

More

Painful Business Partnership? Five Partner Pains that Can Threaten Business Success

This is the first article in a series of five on the root of business partnership troubles. Read each in the series. In this first post, discover whether you've got resentment eroding your trust in your partner.

MoreOther publications by Lorraine McGregor

- Â Interpreting the Language of Organizational Complaints, Hosted by GamePlan HR

- Â Planning Your Business Future with ROI in Mind, hosted by Smythe LLP

- Â Turning the Exit Plan into Action so Your Client Becomes Sale-Ready, hosted by The Exit Planning Institute

- Â What Separates a Business With an Exit Strategy From One that Truly Attracts Buyers? A Podcast Hosted by DreamCatchers

- Â Will Your Business Deliver the ROI You Really Need? Hosted by Hillside Wealth

- Â What Does Return on Investment from my Business Mean to You? Hosted by Spirit West Management

- Â Do you Sell Products Through Distributors? Hosted by Sales Xceleration and Spirit West Management

- Â Do you Have Cash Building Up Inside Your HoldCo? Hosted by Hillside Wealth

- Â TroubleShooting Distributor Partnerships. Hosted by Sales Xceleration and Spirit West Management

- Â Will You Have Enough? Wealth Accumulation & Preservation for Business Owners hosted by Invito Partners and Spirit West Management

- Â TroubleShooting Strategic Partnerships Hosted by Steven Wood Space & IP Attorney & Spirit West Management

- Â Unleash Your Sales Teamâs Potential. Hosted by Spirit West Management

- Â For Wealth Managers â Strategic Wealth Mastery: A Profound Look at What It Takes For Your Client to Earn ROI from their Business

- Â Maximizing Opportunity: A Guide For Setting Up Your Business to be Acquired Hosted by The OutPost

- Shouldnât You Be Making More From Your Business? Hosted by Zada

- Â Not Happy with My Business Valuation: So Now What? Podcast Hosted by Vela Wealth

- Â Growing a Fintech Start-up â Hosted by Whitesales Consulting Liverpool, UK

- Details

- Lorraine McGregor

- Uncategories

Are you Paying Yourself for the Risks You Take as an Owner of a Business? Letâs Find Out

What is/was your big âwhyâ for starting your business?

If you are like many entrepreneurs, the following desires were highly motivational:

- Searching for freedom from the 9-5 salary slog

- Wanting to prove that you could start and grow a business

- Having an idea that would improve or make a difference

- Doing something better or different than what was out there

Often the motivation to start the business needs to evolve into a NEW âWhyâ to keep taking the risks involved in continuing to grow the business.

Yes, itâs time for you to evaluate the Risk vs Reward âWhyâ to keep working on (not in) your business.

You do want a return on investment from this adventure do you not? Beyond making a difference, reporting to no one, and coming up with all the good ideas and the cash to power the goals.

Itâs time for some financial essentials so you know how to earn that return AND build on the return⌠this is wealth accumulation and preservation at work.

1. The Purpose of Paying Your Salary

The salary you earn is what the company pays you to do the functional job the company needs. If you werenât doing it, youâd hire someone at market salary to do it. If you carry more than one role hat, then you might need to assess how much time each month you spend on each job, and apportion your salary accordingly at the market rate for each. Take a moment and assess where you spend your time. It is worth it.

How to accumulate some wealth from Salary?

Save a portion every month. Make it automatic. Get it out of your chequing account and into a Savings account. Save up and invest it outside your business into something that comes with far less risk. Even if itâs just 10%. It builds up. Compounds. You need that for ROI!

Now you are doing 2 things well:

- Wealth accumulation

- Risk diversification

2. The Purpose of Paying a Dividend

A salary is great. You got one when you worked for someone else and they carried the burden of making payroll each month.

But when do you get the reward for taking the risks of being the business owner, carrying the stress of payroll and finding the next bottleneck and solution that will unlock the team and the market, so all your actions (not just plans) move the business forward?

You get paid for taking that risk when you issue a dividend to shareholders⌠thatâs the company awarding you some cash leftover from net profit.

Net Profit is shown on your year-end income statement. It is what is left after the company pays for the cost of goods or services, and the fixed costs of running the business, and the taxes.

The amount left over can be split in several ways.

- It all gets reinvested into the business to pay for next yearâs growth. No reward or ROI for the owners.

- It all goes to dividends. No extra cash for growth for the business unless you borrow or get new investors.

- It can be split between dividends and growth capital. Now the owners receive ROI for taking the risk and the company has some capital to spend on growth initiatives.

3. Be intentional about your Risk vs Return Goals.

Two times a year you need to discuss, weigh and make this choice to enable that dividend to be paid at year end.

At the start of the financial year and at the end when you receive the companyâs income statement from the accountant or CFO.

Otherwise, you get option 1. All money is reinvested into the business. No ROI for your risk.

At the beginning of your financial year, set your intentions for dividends as one of your goals.

Then manage your KPIs all year to ensure the company has the cash to pay the dividend amount at year end.

When you personally receive your dividend check, take the following steps:

How to accumulate some wealth from Dividends?

Save a large portion of that dividend check. Get it out of your chequing account and into a Savings account. Save up and invest it outside your business into something that comes with far less risk with a reliable interest rate or return.

Now you are doing 4 things well:

- Wealth accumulation from salary savings.

- Wealth accumulation from dividend savings.

- Wealth accumulation from other investments.

- Risk diversification away from your business.

Compounding lowers your risk of earning any ROI from being a business owner.

If you want to learn how to get this formula right, create the kind of KPIs that will reliably give you a dividend check so you keep getting paid for taking the risk, then you will want our workshop on this topic. Ask us at This email address is being protected from spambots. You need JavaScript enabled to view it..

It is a richly rewarding investment for you and your business.

- Details

- Fedir

- Uncategories

Business Owner audiences tell Lorraine McGregor they wished they had known to make their companies saleable years ago. All owners should hear her speak so they know their options long before they exit. This email address is being protected from spambots. You need JavaScript enabled to view it.

Business Owner audiences tell Lorraine McGregor they wished they had known to make their companies saleable years ago. All owners should hear her speak so they know their options long before they exit. This email address is being protected from spambots. You need JavaScript enabled to view it.

Lorraine McGregor is available to speak at your conference, in-house training event or client seminar.

Keynotes and ProgramsÂ

All our programs can be delivered in a variety of formats from 45 â 2.5 hour keynotes, seminars or in depth training. We are willing to facilitate break out sessions and customize to suit your audience.

Â

FOR BUSINESS OWNERS

Does your trade association have many boomer business owners? How about your distribution network or supply chain? What about your city or town? They all need to learn how to grow their business to the next level so it becomes saleable. Most companies are un-saleable and un-transferrable and donât know it. Help them learn how by inviting us to speak.

Topic List:

- Should you or Shouldnât you Sell your Business? â With co-presenter James Ferguson, RBC Â Wealth Management

- How to Increase the Value of Your Business BEFORE You Sell ⌠and Make It More Profitable Now â This presentation is customized for Manufacturers, Distributors, Retailers, Contractors, Professional Services, in most industries.

- Five Steps to Personal and Financial Freedom for Boomer Business Owners. Â With co-presenter Jack Beauregard, Founder STPI

- Will Your Companyâs Distributors Be Able to Sell Their Companies or Will They Close?

- Will Your Companyâs Supply Chain Be Able to Sell Their Companies or Will They Close?

-

How to Find the Secret Sauce so Your Business Will Grow to the Next Level

-

How to Grow a Business to the Next Level & Make it More Profitable

Â

FOR LAWYERS, ACCOUNTANTS, FINANCIAL PLANNERS, BANKERS, INSURANCE AGENTS OR ESTATE AND TAX SPECIALISTS

Do you do in house training sessions to keep your professionals at the top of their game? Invite us to speak at your next in-house event or conference so your people understand the differences between making a business saleable and succession planning. Most owners donât know and neither do advisors. With 90% of most boomer owners struggling to find buyers because they did not prepare their business so it is transferrable AND saleable, they need your advice more than ever. Lorraineâs seminars are not only proven to add value for your clients (client retention!!) but are cost effective in prospecting new business-owner clients and positioning you, the advisor, as a business owner specialist.

Topic List:

- When and How Should Your Clients Sell Their Companies â With James Ferguson, RBC Wealth Management

- The Secret to Increasing the Value of Assets Under Management

Â

Meeting Planning FAQ

You will find it easy to work with Lorraine and her speaking partners so your event goes smoothly. She is professional and prepared, ready to adjust to the needs of the audience. Lorraine has spoken to audiences from 10 to 1000 from in-house training sessions to national conferences and led break-out sessions. Let us know what is important to you.

Fees

- If you would like to book Lorraine and her speaking partners, please contact Sarah Thomson at 609-216-6002. Lorraineâs speaking services can be covered in a variety of flexible arrangements depending on your interests and budget.

- A 50% deposit and a signed program agreement will secure your date.

- The balance of the fees agreed on are due on or before the date of the presentation. Any incidental expenses (such as shuttle or cab fare) plus other travel will be billed immediately following the presentation and will be due within 30 days.

- Lorraine will clearly discuss expenses with the meeting planner, and will not incur any that are unnecessary. She works very hard to keep all costs to the meeting planner to a reasonable minimum.

Travel Arrangements

- Lorraine and her partners typically make their own airline reservations, but will work with your travel agent if you prefer.

- Ordinarily the meeting planner will make the hotel arrangement. A non-smoking, guaranteed for late arrival room in preferred.

- If your event is in NW Washington State or Southern BC, Lorraine and James will probably drive to your event. The mileage rate is $0.47 per km (or $0.67 per mile). Should your event be in the Boston area, Jack will drive to the event and Lorraine will fly.

- You may choose how you want Lorraine and partners to get from your local airport to the hotel/venue where your event will be held. Shuttle cars, cab, rental car and pick-up are all options. Lorraine will need to be reimbursed for any amount spent on ground transportation.

Room Set up and A/V Equipment

- Microphone: A cordless lapel mic are our speakersâ first choice, so they can move around and better interact with the audience. A hand-held cordless microphone with mic stand is the second choice. The last is a corded handheld microphone. If you choose the third option please make sure it has a long cord so they can move around, and of course always ensure there is a mic stand.

- Staging: Lorraine does not speak behind a lectern. A podium or riser in a large room will help your audienceâs line of sight. Please make sure the audience is at a close distance to the speaker and that people sit close together (not scattered around the room), as this will create more intimacy, fun and better learning.

- Lighting: Although Lorraine does use a slide presentation, she prefers stronger lighting as opposed to dimmer lighting. Since Lorraine sometimes acts out stories itâs best if there is good lighting on her, and because she likes the audience to interact with each other, please ensure there is sufficient lighting in the audience.

- Slide presentation: An LCD projector and a large screen are used in our presentations. Please let Lorraine know ahead of time whether or not there will be a laptop computer and remote to use, or if she should bring her own. Please extend the screen as high as possible, and be sure there are no lights directly above the screen. The rest of the room should be well lit. One 6-8 foot table is needed for the LCD projector to be set vertically (T).

- Arrangement of the room: Please let Lorraine know ahead of time what kind of seating arrangement you prefer. If you grant permission for products to be sold, a 6-8 foot table is also required at the front of the meeting room. It is appreciated if the host would announce that learning resources are available immediately following Lorraineâs presentation.

- Introduction: You will receive a copy of Lorraineâs and her partnersâ introductions prior to the event. Lorraine will bring an extra copy with her. Please assign someone who is comfortable in front of an audience to give the introduction. It is helpful if Lorraine can have a moment or two with that person prior to the presentation.

- Resource handouts: Lorraine will send you masters of any applicable resource handouts 15-30 days prior to the event.

- A/V person: Please arrange with the A/V or logistics organizer for the meeting to deal directly with Lorraine so that she may ensure the room is set up in a way that will make her presentation go as successfully as possible.

Free Resources

- All attendees will be invited to subscribe to our free monthly newsletter âMaking Your Business More Profitableâ

- You may want to increase your registration in advance by offering our âIs Your Business Saleableâ or âIs Your Business Ready for Growthâ Quizzes. We can make them available as part of the fee as an added bonus to build attendance for the first 10-100 to register.

- We would be happy to write an article in advance of your event for your website or publication.

- All of our books are available on our products page that your members can use to gain greater mastery over the topic of growing a business and making it saleable.

- Details

- Lorraine McGregor

- Uncategories

Let's explore the possibilities and then the right answer might emerge.

Want to find out what weâre like to work with? Hard to tell from a website, isnât it? Just hit this button to schedule a 30 minute call on us. Schedule a 30 min call

- Address:Â 1597Â Isleview Lane, Bowen Island, BC, Canada V0N1G2

- In Canada call: +1 604.306.7707

- Mail: This email address is being protected from spambots. You need JavaScript enabled to view it.