Value Enhancement

What do we mean by the word âValueâ with respect to your business? Stand in the shoes of an investor looking at whether to acquire your company. Investors search for value inside your business that will reliably grow the company forward in the future.

Who is the chief investor in your business?

Itâs you and your fellow partners, shareholders or family members that have built the business. This fact is often a bit of surprise to owners. As the number one investor, you may want to broaden your understanding of the term âvalue enhancementâ so that you can evaluate how to create a better return for your shareholders.

Value enhancement solutions should be one of your strategic objectives each year. Finding ways to increase the perceived value to an outside investor means your business will be attractive to lenders, investors or acquirers. And that will pay off for you every single time.

We have a simple but profound diagnostic that will help you see your company from the perspective of an investor. The process of uncovering your Red Flags and highlight your Green Lights is very educational and illuminating for an owner.

Our diagnostic covers everything from the way your company processes invoices to how people are managed. The purpose is to uncover the Red Flags that make profitability, productivity, and performance challenging. All the same things an investor wants to âflagâ in their due diligence before acquiring a company.

When you know what your Red Flags are, you can do something about them. Our solutions cover every Red Flag weâve ever seen. We rank them in terms of priorities so that you work on one or two changes at a time that deliver the most bottom line value.

Our clients often find the company is easier to manage and more enjoyable to lead, after working through this Value Enhancement exercise.

And what about those Green Lights? Those are the X-Factors you already have in place that prove your business is competitive, successful and effective at earning a return on investment. The more Red Flags you can turn into Green Lights, the higher the perceived and real value of your firm.

For more insights into how we help you enhance value in your business, check out these articles and our best selling book:

- Details

- Lorraine McGregor

- Value Enhancement

A better Question is: Am I Certain Selling is My Best Option?

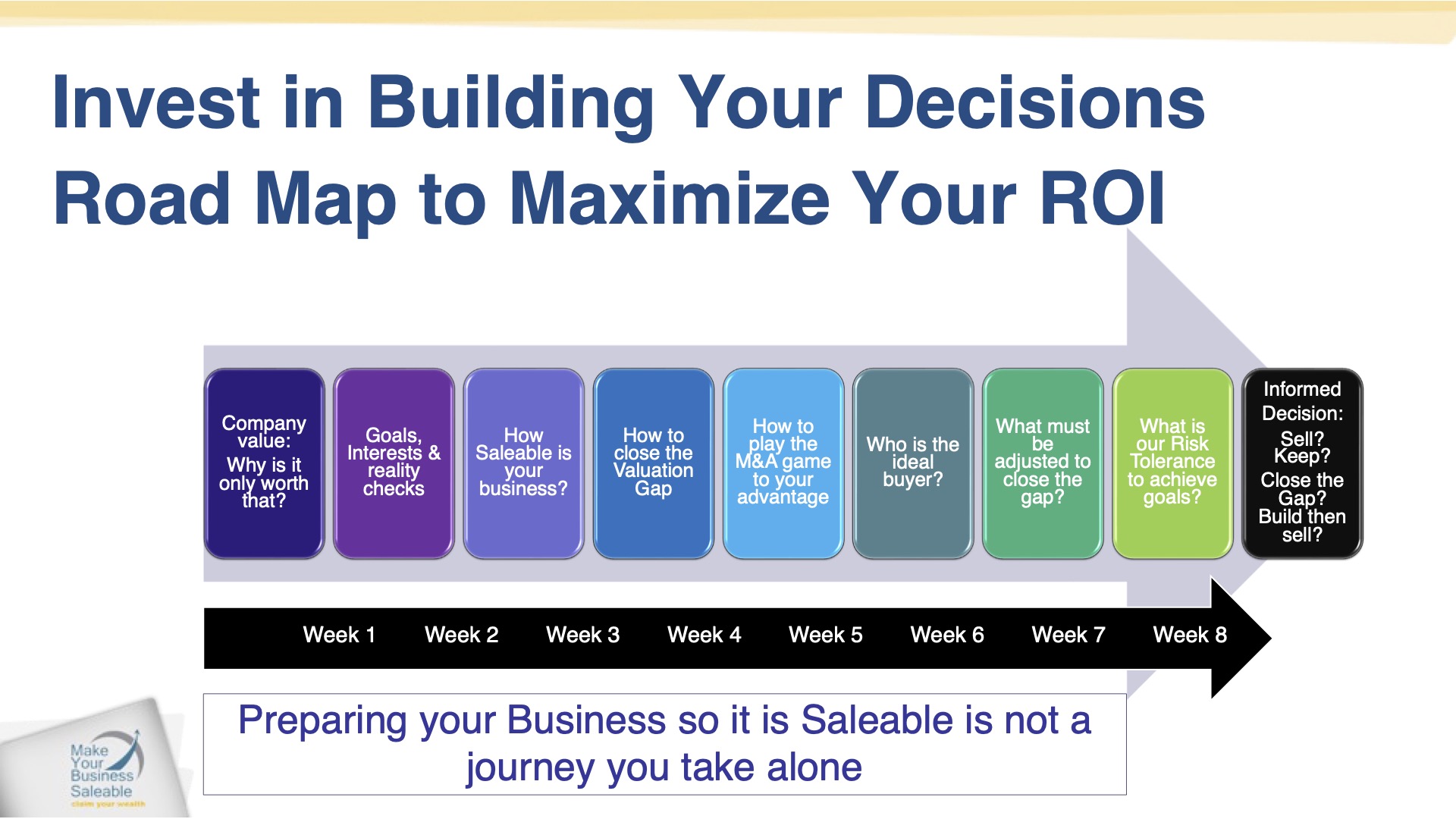

Making the optimal decision about when to sell, if you should sell, is your company ready to sell and what will it mean for my future, for my wealth and for my employees and all Iâm leaving behind is a complex process. Sometimes the answers pull you in multiple directions. Often you donât find out you hadnât asked the right questions until itâs too late to manage the process to an outcome you can live with.

- Details

- Lorraine McGregor

- Value Enhancement

A Crash Course in Valuing Your Business

- Details

- Lorraine McGregor

- Value Enhancement

- Details

- Lorraine McGregor

- Value Enhancement

Hopefully Toward Your Top 3 Strategic Priorities

- Details

- Lorraine McGregor

- Value Enhancement

- Details

- Lorraine McGregor

- Value Enhancement

I was at an ACG (Association for Corporate Growth) luncheon a few months ago. Thatâs the professional association of deal makers, â all the advisors that help buyers find the perfect seller and transact the deal. I used to be the President of the Vancouver chapter.

- Details

- Lorraine McGregor

- Value Enhancement

I know what keeps business owners up at night. Itâs that slow silent steady drip of cash leaking away from the bank account each month. Your company may have profit leaks. Leaks show up in the places you are not looking.

- Details

- Lorraine McGregor

- Value Enhancement

HOW TO BECOME A HIGH-NET WORTH ENTREPRENEUR.

- Details

- Lorraine McGregor

- Value Enhancement

- Details

- Lorraine McGregor

- Value Enhancement

Use this Checklist to Evaluate Whether You Are Ready to Sell Your Business

Business Valuation Quizzes

Company Growth Quiz

You will be gone through step-by-step evaluation process that will discover both strong and weak sides of your business. In such a way you will have a second opinion, fresh look at the current situation and as a consequence you will be able to take necessary actions if you think those are good points to apply.

Is your Company Saleable?

Every business owner should know if their biggest asset is saleable. Learn inside tips to improve your odds and test yourself.

Subscribe

Want to receive more insights on business performance or making your business saleble?