Youâve worked hard to build your company. How do you want to get a return on all that you have invested. Read on to get your questions answered about how to be successful and the 5 steps to take, starting now to get the best possible result.

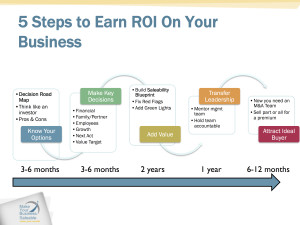

Getting your ROI is a 5 step process. Itâs not something you want to do all at once the year you suddenly have to sell or want to sell. To get the best return, give yourself several years to plan and then enact your saleability blueprint.

Step 1 â Know Your Options

Coming to terms with how you want to profit from owning a business could be an easy decision or one wrapped up many dilemmas.

It seems easy to say, âYes, when the time comes, Iâll sell.â But gets complicated if youâve got any of the following situations:

- A business partner

- A health problem

- Family associated with the business

- Employees  you would like to reward

- No family in the business

- A family member not ready/able to take over the business

- Promises made to employees or family about your interest in having them buy shares, or become an owner one day

- What your next act might be

- What you would do if you didnât lead the business anymore

- Whatâs going on in your industry

- Confusion about what the business is really worth

- Potential âbuyer interestâ that is hard to evaluate

- An idea that selling is associated with a certain age

- A desire to sell part of a business but not have to deal with partners

- A passion to keep growing it and an interest in getting your ROI before itâs too late

- Confusion about who to call first to even look at any of these issues

- Mistrust of what youâve heard about exiting, succession and selling that just doesnât sit right

- Your frustrated with the mixed messages you are getting about what to do with your business just because youâre growing older

- You get phone calls and letters from brokers and advisors saying they have a buyer waiting in the wings and you wonder how come they know so much about your business

- Youâre waiting for a son or daughter to step forward and tell you they want to take over

- Youâre waiting for the market to change or your instincts to tell you this is a good time to sell

If youâve got some of these concerns, then itâs really hard to take the right steps to get a return on investment. Our Decision Road Map program helps you navigate these choppy waters so you come out with a decision you feel certain about that meets all your needs and those around you.

During the Decision Road Map, you gain insight into:

- How your company is valued, and why value is really what a willing buyer will pay, not what the accountant says.

- What a buyer looks for and why;

- How to think of your business like an investor;

- Who might buy it, what they are looking for;

- What it would be like to sell to employees vs another company;

- How all these decisions will affect your personal financial situation, your company legacy, what you can sell your company for, your next act;

- The changes you will have to make inside your business so it is transferrable to another buyer, of interest to their investment goals and worth what you want to sell it for during the time that ideal buyer is looking.

There are a lot of myths out there about selling a business. We will answer your questions and sort out whatâs true and what isnât. This FAQ might help you:

Q: Would I be able to sell my type of business?

A: Yes, if you have done the work that makeâs it transferrable and worth what you want to sell it for and made it attractive to the ideal buyer. We wrote the book on how to do this.

Q. Can I sell some of position in my business?

A: Yes, thatâs entirely possible, especially if you make it saleable and attractive to the ideal investor. Talk to us about what you want, we will show you whatâs possible and what isnât. Then you can make an informed choice. We will connect you to investors.

Q: Iâve been told by so many different advisors what my company is worth. Which number do I believe?

A: The short answer is, donât bet you can sell it for any of the numbers  youâve been âquotedâ. Value is in the eye of the buyer. What you value and what they value will be very different. What your company is worth today is your baseline number. You need to add the âsaleable valueâ that a buyer is looking for. Then it will be worth what you want to sell it for to a buyer that wants it for that price. Our four-step proven system leads you through this complex maze.

Â

Q: Iâm thinking itâs time to sell this year. Who should I call to get the transaction done?

A: Us. Except that your business is not ready for the transaction. Donât skip the step of preparing it so it is saleable. If you go to an investment banker, business broker or mergers and acquisitions advisor, they will determine whether they want to represent your business⊠or not. You may have to pay them to get that decision made. You are presenting them with a business that has not been made saleable so itâs pretty difficult for a valuation to be done that will reflect what you want to sell it for. Going to another broker for a second or third opinion does not change the fact that your business isnât worth what you want to sell it for⊠yet.

Q: My partner wants to sell. I donât. We canât see eye to eye on this. What can I do?

A: You may be able to arrange to buy your partner out. Your business will need to be prepared so an investor or lender sees it as a good risk to invest in. Yes, sometimes the company can make the payments to support your personal buy out. But first, you and your partner need to have a facilitated open and frank conversation about whatâs important to each of you AND the business. Let our trained coaches help you hear what the other is saying, and get your interests on the table so you can hatch a good plan before the company suffers a set back because the leaders are distracted with this problem. Set up your appointment by calling 604-377-4307.

Q: Iâve already done a succession plan. Iâve got my holding company and my tax structure set up. Iâm ready to sell. Whatâs the next step?

A: Actually, a succession plan is only part of the process of getting a return on your investment in your business. You have to know your company is in saleable condition before you attempt to put it on the market. There is nothing worse than trying to sell a business that has been shopped around and rejected. Ask for our Saleability Checklist to see if indeed your business is ready for the market.

Q:Â We have many distributors that we count on to sell our products. Many are getting to an age where they might want to exit. How can we make sure they donât just close, leaving us without key channel partners?

A: You are right. This is a huge issue for many unsuspecting manufacturers. 50% of all businesses today are owned by aging boomers. Given that 90% will fail to find buyers because they didnât know they should become saleable OR they had to exit suddenly due to health or industry changes, you should be very worried. Assess your vulnerability. Look at the 20% that drive 80% of your revenue. Of these 20%, how many have owners still active in the company who are over 55? Now you know whether an intervention is needed. We can work with groups of businesses on their Saleability Blueprints. Hold a conference. Invite us to speak. Weâll help your company and your distributors with a game plan that gives everyone financial certainty over their future.

Q: I want to make sure my company is worth what I want to sell it for when my ideal buyer is looking. How do I get that financial certainty?

A: Great question!  Letâs help you by sorting through all your questions and concerns so you know what you will have to change inside your business to make it worth what you want to sell it for so it is attractive to the next owner.

- Make your company saleable 2-4 years before your exit date.

- Depending on your next act, post sale, the business has to become far less dependent on you long before your exit date.

- The trick to getting a buyer and a premium? Become the acquisition your ideal buyers look for.

Your first step is to learn what it means to make your business saleable and decide if this is the future you want. There are many questions you will want to reflect on to make this choice. Your financial future will look very different if you join the 90% who hope to sell, donât do the preparation and then canât find a buyer.

Once youâve committed to this path, Step 2 is to build your Saleability Blueprint. The choices you make in this Blueprint will shape all your decisions from this point on.

Itâs a complicated jig saw puzzle to examine all the impacts for each scenario that you are considering: What you want to do might not match up with what is happening in the market place. Your time frame might be shorter or longer than whatâs possible to achieve. Your industry and your ability to stay abreast of changes will affect which buyer is best to aim for. The changes you make inside your business will be very different depending on the type of buyer you select. You must weigh the consequences of each decision on your tolerance for risk, your team, family needs, financial interests and a host of uncontrollable variables.

Itâs a complicated jig saw puzzle to examine all the impacts for each scenario that you are considering: What you want to do might not match up with what is happening in the market place. Your time frame might be shorter or longer than whatâs possible to achieve. Your industry and your ability to stay abreast of changes will affect which buyer is best to aim for. The changes you make inside your business will be very different depending on the type of buyer you select. You must weigh the consequences of each decision on your tolerance for risk, your team, family needs, financial interests and a host of uncontrollable variables.

By working through the questions in our Blueprint (on your own or with us), you feel confident making your commitment to this path.

Step 3 is to get help implementing your Saleability Blueprint as a project so your company makes the right changes to build in the economic value buyers search for. Can you lead the project? Are you good at helping your employees through change? Work to your strengths and get help in other areas.

What do you tell your employees as you implement these changes? Youâre growing the company to the next level (itâs the same activities as making it saleable!). Itâs exciting times in your business.

How to Get Started

Buy our âMake Your Business Saleableâ Self-Guided Resource System which includes our text books for all our programs.

DECIDE IF YOU WANT ASSISTANCE:

We can offer you three options to suit your learning style, budget and time frame:

1. Private one-on-one consulting to help you customize your Blueprint so it suits the needs of you, your partners, your family and your type of business. We donât just plan with you, we are also able to implement these changes inside your business until your company is worth what you want to sell it for.

OR

2. Certainty â A Boot Camp Join 8-10 business owners who have made the same commitment you have: to grow to the next level, improve profitability and make the business saleable so its ready when the ideal buyer comes calling. You will be on their radar if you follow this plan. This is an intense learning experience led by a team of experts where you will create your Blueprint and implement the strategies that will double the value of your business and make it easier to manage.

OR

3. Accountability Coaching If you are the kind of person that likes to talk through your plans and ideas and then go implement your decisions on your own and report back your experiences, then you will like this program. We talk on a regular schedule. You have homework and you use the resource system as your guide.

If youâre reading this, youâre ready to learn what it takes to make your business an asset worth selling. If youâre exit date is at least 18 months away, we can show you the way to hit a home run.

Bringing on experts to help you get there is the right next step. Itâs what the companies that get premium offers from eager buyers do. Letâs talk about your ideal buyer. Call 604-306-7707 or

Want to know more about our work in developing the concept of Saleability? Read more here

Want to find out if your company is saleable? Take our quiz